China’s Paper Products Production and Export

China is the world’s largest producer of paper products and the world’s second largest packaging country after the United States. The overall output value of the industry is relatively large and the variety of paper products is abundant. As China’s domestic demand for paper products has increased year by year, it has promoted the rapid update of product quality and types by manufacturers. In the international market, Chinese paper products are also welcomed by many countries for their good quality, variety, and price advantage.

Paper Product Industries

In 2019, China’s paper and cardboard container manufacturing enterprises above designated size (main business annual revenue of more than 3 million US dollars) achieved overall revenue of 289.717 billion. China’s paper products packaging products are mainly cardboard and paper products. Since the vast majority of enterprises in paper packaging industry are Private Enterprises, small and medium-sized account for more than 60%, and CR5 market share is less than 10%.

The entry barriers for industry manufacturers are low, and downstream industries are broad. Many small carton factories are dependent on local demand, there are many small and medium-sized carton factories at the low end of the industry, forming an extremely dispersed industry pattern geographically. The main reasons causing the fragmentation of the competitions are : labor-intensive industry, printing equipment, and a certain degree of capital barriers. But small and medium firms with low labor costs still survive as the industry is still relatively low barriers to entry. Products are sensitive to transport cost, with a transportation radius of 100-150 km and led to regional separation of small and medium sized manufacturers. Therefore, this may not be a good phenomenon for international buyers, because a large number of production companies and highly dispersed geographical locations have caused large differences in product prices and characteristics. For products of the same quality, depending on the region where the manufacturer is located, and in terms of power and energy, water resources, labor costs, financial policies, operating costs, transportation and other different policies. The price may be very different and are not conducive to screening out ideal products.

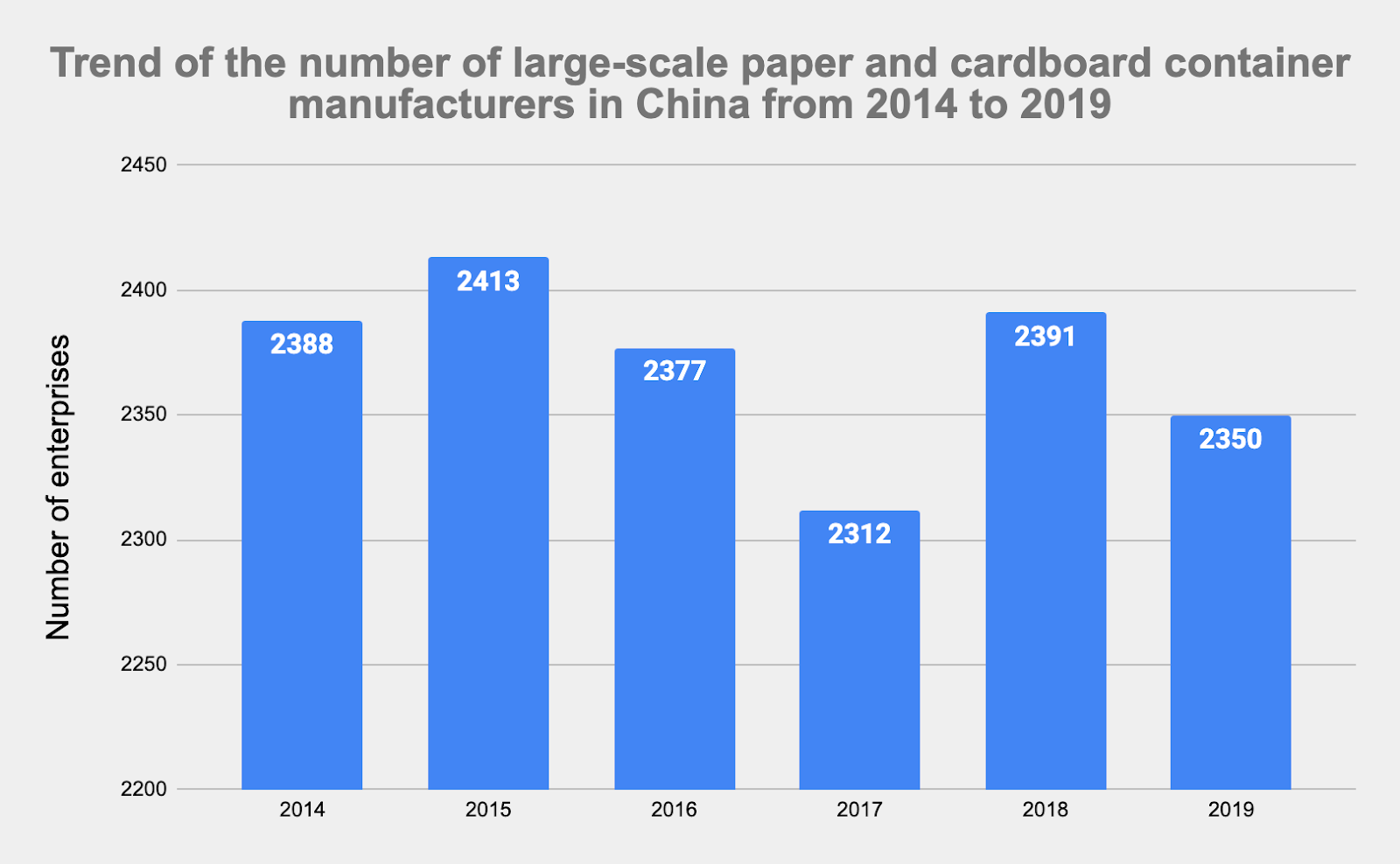

Large Scale Manufacturers

According to data released by the China Packaging Federation, as of the end of 2019, the size in the paper and cardboard container industry (of enterprises with annual revenues of more than 3 million US dollars) was about 2,350. Since 2014, the number of companies has basically remained at around 2,300.

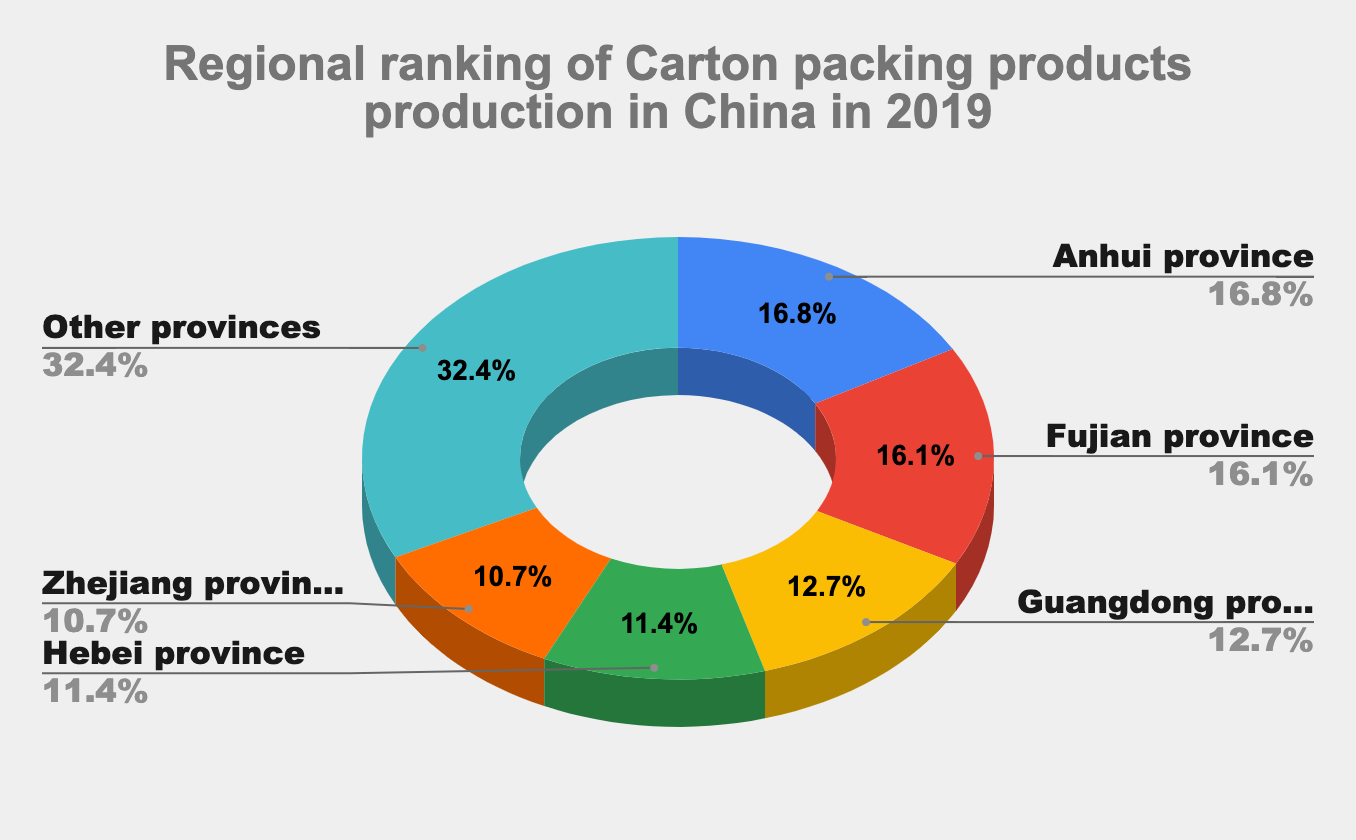

Production Output – Cardboard & Carton

In 2019, China’s cardboard container board industry completed a cumulative output of 13,015,600 tons, a year-on-year increase of 6.62%. The top five regions in terms of output are Anhui Province, Fujian Province, Guangdong Province, Hebei Province, and Zhejiang Province. Among them: Anhui Province completed a cumulative output of 2.183 million tons; Fujian Province completed a cumulative output of 2.0988 million tons; Guangdong Province completed a cumulative output of 1.6493 million tons; Hebei Province completed a cumulative output of 1,483,400 tons; Zhejiang completed a cumulative output of 1,380,400 tons.

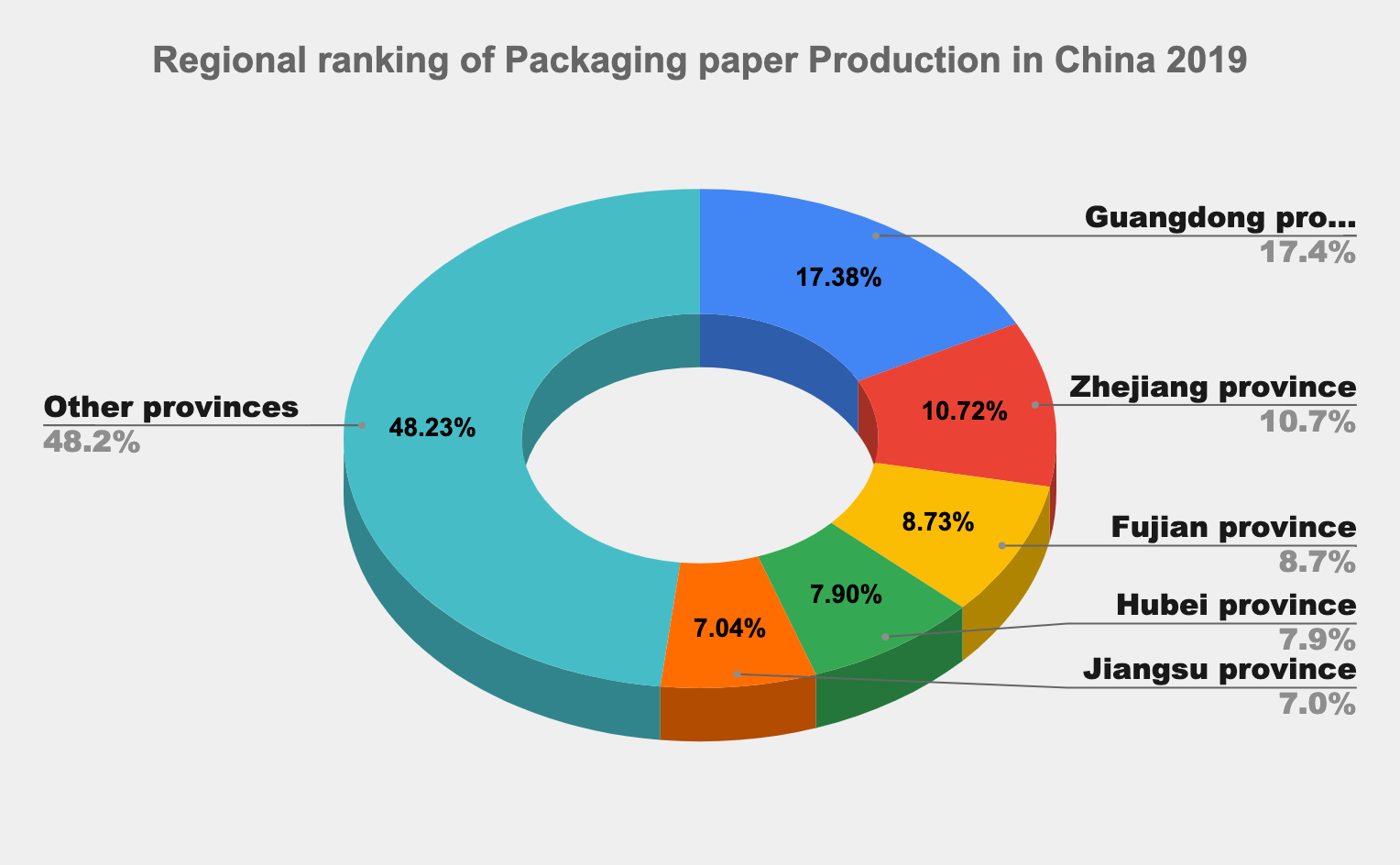

Production Output – Paper Packaging

In terms of paper products, including paper bags and bulk packaging paper, China completed a production of 72,191,600 tons in 2019, a year-on-year increase of 1.90%. The top five regions in terms of production were Guangdong, Zhejiang, Fujian, Hubei and Jiangsu, among which Guangdong completed Cumulative output was 12.5462 million tons; Zhejiang completed a cumulative output of 7,735,900 tons; Fujian completed a cumulative output of 6,305,300 tons; Hubei completed a cumulative output of 5,706,400 tons; Jiangsu completed a cumulative output of 5.0852 million tons.

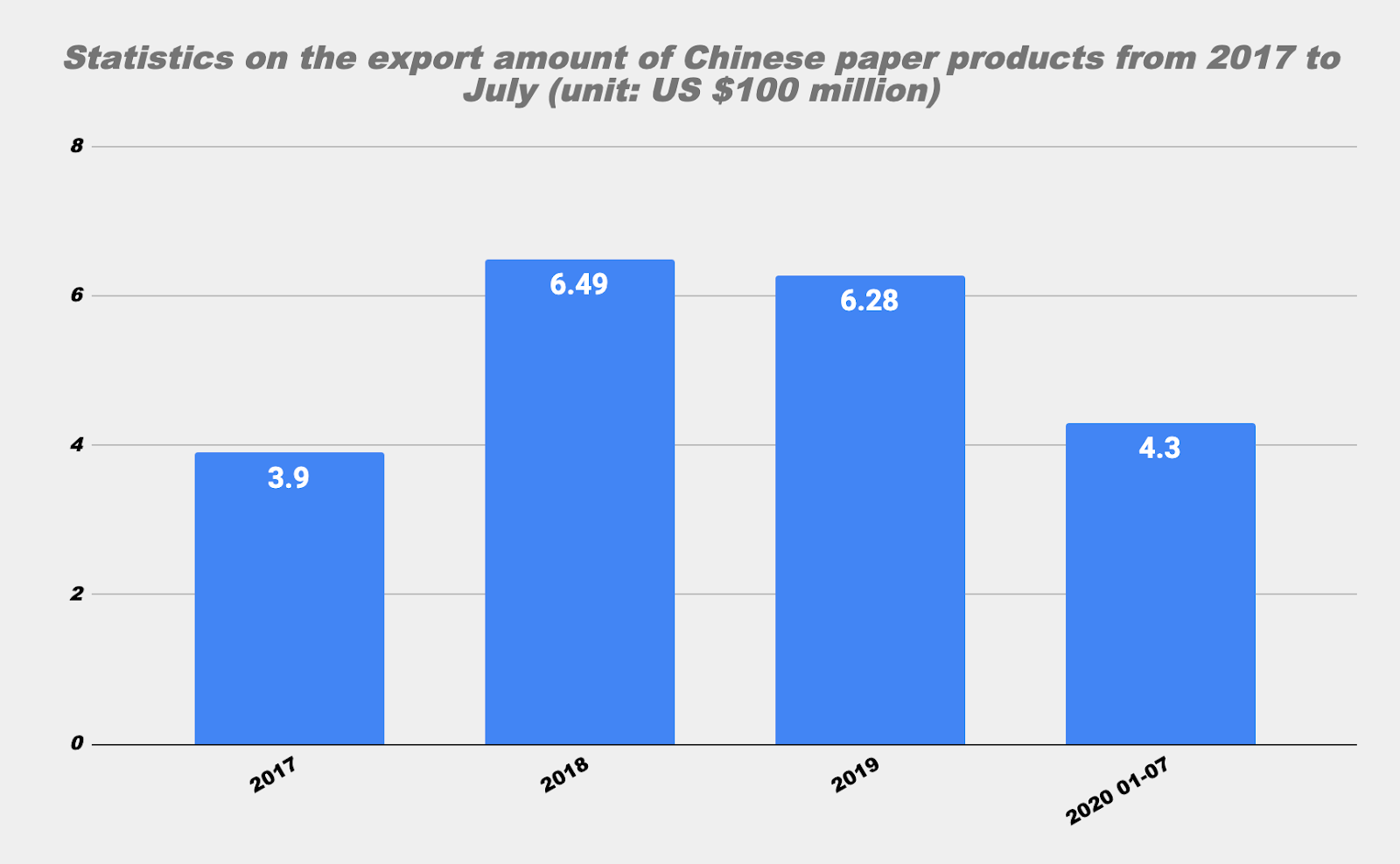

Total Export

Since 2017, China’s exports of paper products have continued to grow throughout the year. In 2017, it was US$390 million; in 2018, it was US$649 million; in 2019, it was US$628 million. By the end of July 2020, exports were US$430 million. It shows a continuous growth trend.

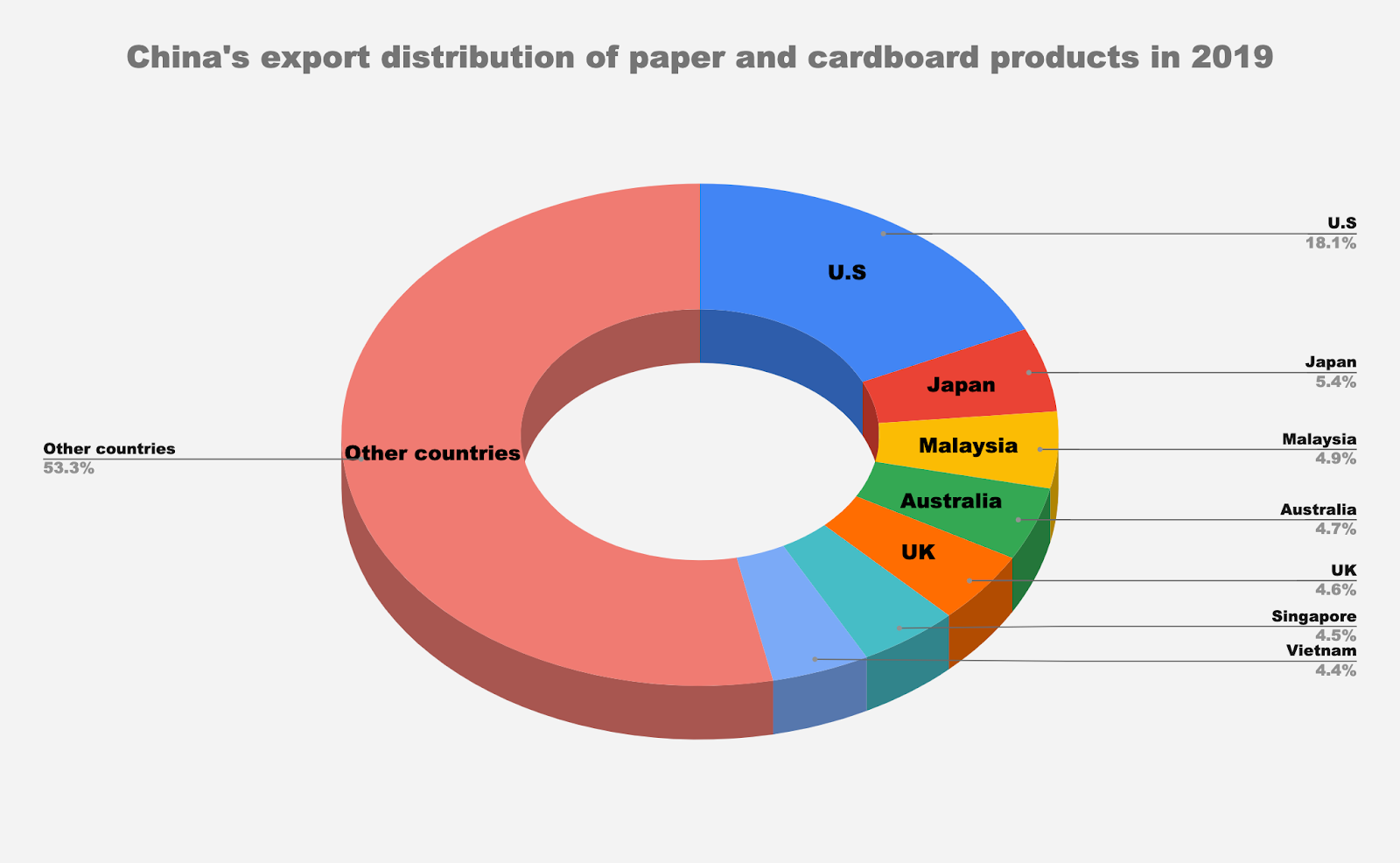

Export by Countries

In 2019, the total export value of China’s paper and paperboard products (Chapter 48 of the Chinese Customs Classification: Paper and Paperboard; pulp, paper or paperboard products as statistical items) total USD 13.249 billion. The top seven countries are the United States of US$2.488 billion; Japan US$716 million; Malaysia US$656 million; Australia US$628 million; United Kingdom US$615 million; Singapore US$603 million; and Vietnam US$591 million.

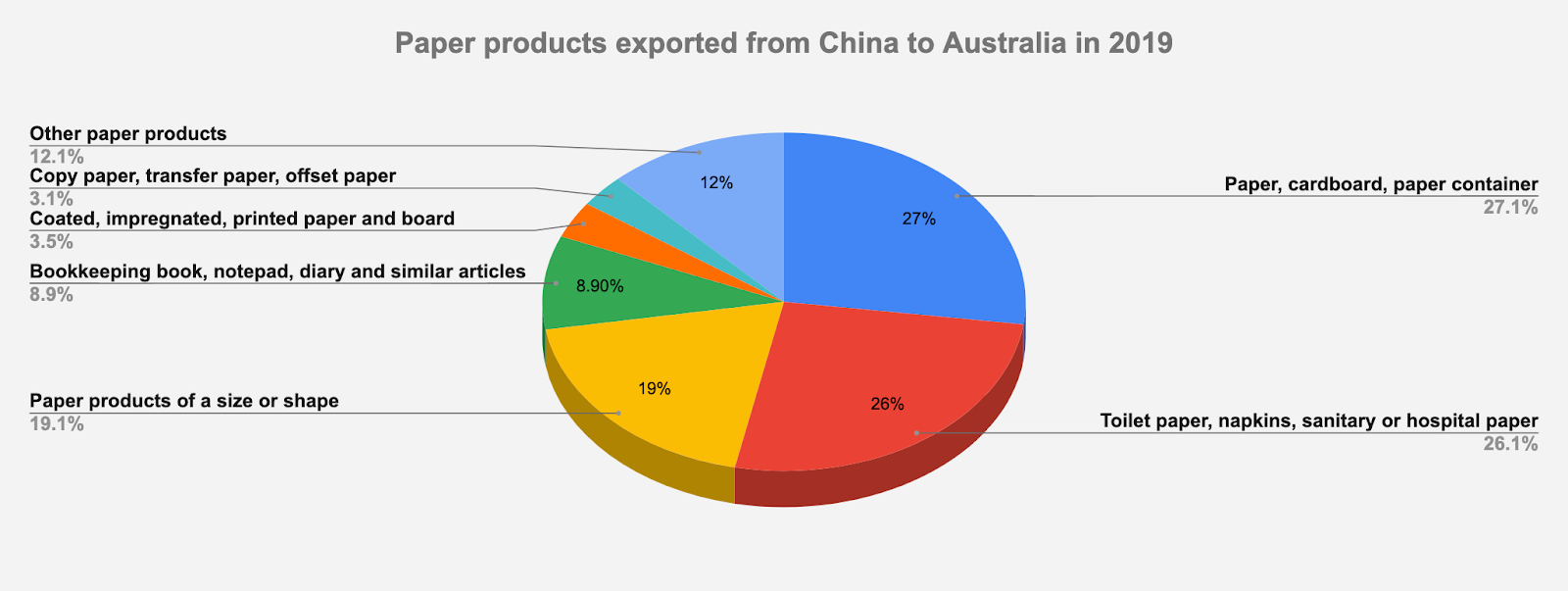

Export by Product Types

In 2019, China’s exports of paper and paper products to Australia total US$628 million. According to statistics, the top six paper and paper products were paper, cardboard, cartons and other paper containers at US$175 million; toilet paper, napkins, sanitary or hospital paper at US$163 million; paper and cardboard cut into a certain size or shape and their products at US$121 million; accounting books, notebooks, registration books and similar products at US$56 million; after coating, impregnation, dyeing, Printed paper and cardboard were US$22 million; copy paper, transfer paper, mimeograph paper, and offset printing paper were US$22 million.