Massage chairs

There are 1,320 massage chairs manufacturers in China, mainly in Guangdong, Zhejiang, Fujian, and Jiangsu provinces. There are other massage chair manufacturers in other provinces too, but the products are mainly concentrated in the low-end market, and the quantity and product quality are not as good as the above-mentioned four provinces.

There are 6 massage chair manufacturers with registered capital of over 10 million Australian dollars in Guangdong Province, 8 in Zhejiang Province, 5 in Jiangsu Province, and 1 in Fujian Province. Massage chair production bases are in Fu’an City of Fujian Province, Xiamen City of Fujian Province, Foshan City of Guangdong Province and Anji County of Zhejiang Province.

Massage culture originated from the theory of Chinese traditional medicine meridians and is mainly used to relieve human back pain and other sub-health symptoms. It’s main consumer group is the elderly. In recent years, as the sub-health group has become younger, the consumer group of massage appliances has also become younger. From the perspective of global layout, the main consumer areas of massage appliances are East Asia and Southeast Asia countries and regions with strong massage and health care culture. In addition to Asia, North America and Europe also have a certain demand for massage chairs due to their strong consumption power in economically developed regions.

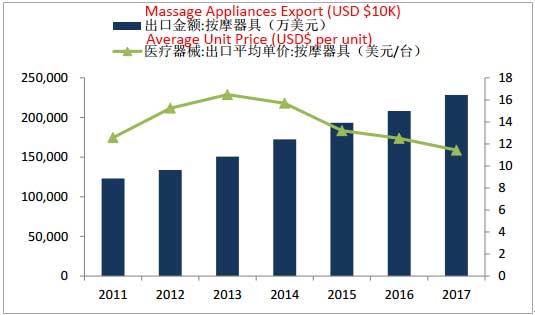

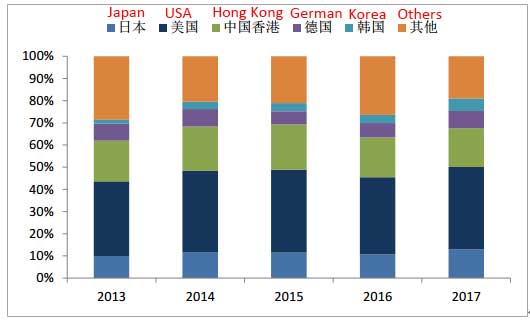

The global massage appliance industry chain has shifted, and China has become the largest exporter of massage appliances many years ago. In 2017, the total export volume was 2.286 billion US dollars, a year-on-year increase of 9.7%, but on average the export unit price has continued to decline since 2013. In 2017, it was US$10.05 per unit, a 12% year-on-year decrease. Japan, the United States, South Korea, Hong Kong and Germany are the main importers of massage appliances from China, accounting for over 60% of exports.

The competition pattern of the Chinese massage appliance market is as follows: small and medium-sized enterprises participate in disorderly competition in the low-end market, and large enterprises compete for the high-end market, and the market concentration is relatively high. It can be roughly divided into four types of companies: The first type is OSIM, Rongtai and Aojiahua. OSIM has been established for a long time, and it has occupied the leading position in the domestic market in terms of market share and brand awareness. Rongtai and OGAWA (formerly Mengfali) has developed rapidly in recent years, and its market share has continued to increase. According to rough estimates, the current market share of the three companies’ massage appliances accounts for 36% of the Chinese domestic market. The second category is Japanese investment Brands such as Fuji, Panasonic, Inada, etc. Although Japanese brands have a large production volume, their products are mainly exported to their home markets, and their market share in China is not high; The third category is China’s other local brands such as Haozhonghao’s iRest. These brands also have a certain degree of market visibility; The fourth category is China’s small and medium-sized enterprises, mainly concentrated in the low-end market, the degree of brand differentiation is not high, and the market share and popularity of each company is low.

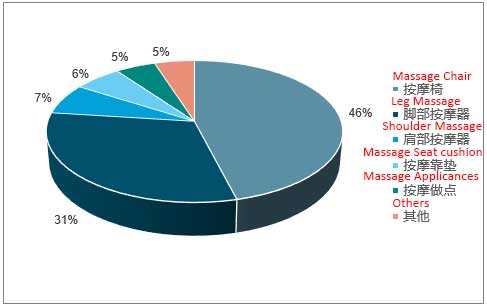

Massage chairs account for 46% of China’s domestic massage appliance market

In 2020, China’s export of massage appliances to Australia is USD$72,589,670.

With the emergence of shared massage chairs in 2018, consumer education has been continuously strengthened, and more and more people are aware of massage chairs, and the market penetration rate of massage chairs is expected to further increase in the future.

At present, the social economy of most countries is generally fast-paced, under great pressure, and the number of sub-healthy people continues to increase, suffering from chronic diseases such as cervical spine, lumbar spine and poor blood circulation. The emergence of massage chairs can conveniently and specifically adjust and relax the uncomfortable parts of the body. The sub-health group is a potential customer group for massage chair products, and the market is large. At this stage, most consumers are restricted by their spending power, and the scale of development of the massage chair market is generally limited. Therefore, high-income groups with relatively affluent lives and a stronger sense of healthy consumption are the key targets for the development of the massage chair market. With the increase in income, consumers’ awareness of healthy consumption will also increase, and the market size of massage chairs is also expected to achieve steady growth.

With people’s pursuit of the concept of great health and health care, the health care products have become popular, such as massage chairs, which have become products that consumers buy or consider buying. In the search index for health appliances, massage chairs are the second most searched, second only to massagers.

China is a global massage appliance research and development and manufacturing center, and has formed an industrial chain integrating design, production, sales and service. The overall supply of the industry is relatively sufficient. In addition to satisfying domestic market consumption, products are also exported to other countries and regions around the world. At present, massage appliances have become the segmented product with the largest export value in China’s medical equipment industry. In 2018, China’s massage appliance exports reached US$2.63 billion, an increase of 15.0% year-on-year. The United States, South Korea and Japan are the top three export destinations of China’s massage appliance products. In 2018, China’s exports to the above regions accounted for 26.45%, 13.20%, and 11.53% of the total massage appliance exports in the same period, followed by Germany as a representative of Europe.

In recent years, the consumption concept of massage health appliances, especially high-cost massage chairs, has gradually changed. The market size of domestic massage appliances in China has been increasing year by year. From 2010 to 2016, the market size of massage chairs increased from 4.86 billion yuan to 106 billion yuan, with a compound growth rate of 13.88%. By 2016, the Chinese massage chair market exceeded the ten billion mark for the first time.

The traditional consumer target group of massage chairs is middle-aged and elderly people, but with the spread of health-preserving habits, young people have also begun to become the target users of massage chairs. The number of massage service merchants has shown an increasing trend, which to a certain extent reflects the demand for massage services by the young and middle-aged groups. In 2019, Dianping APP (a life service mobile phone application most frequently used by Chinese people) reached 26,896 merchants providing massage services, of which, foot massage merchants accounted for 40% of health service merchants.

Shared massage is an emerging model arising from the combination of the massage chair industry and the sharing economy model. Like other sharing economy models, shared massage chairs are also a time-sharing rental model. Shared massage operators lay massage chairs in public places such as shopping malls and theaters, and conduct batch operation and management of massage chairs through mobile payment and the Internet of Things cloud system. At present, the price of massage chairs on the market is relatively high, ranging from several thousand yuan to tens of thousands of yuan, and the proportion of consumers buying is still relatively small. With the prevalence of the concept of sharing economy, personal massage chairs have been idle for a long time and can easily become shared products. Use the fragmented time of leisure, business and other scenes to provide services, and users can enjoy health services without spending a large amount of money.