Pet Products Manufacturers and Exports

Industries

In the past 10 years, the market size of China’s pet industry has increased by 12 times. In 2019, the consumption of China’s pet market was 202.4 billion yuan, and it is expected to reach 295.3 billion yuan in 2020. The market size has doubled in five years from 2015 to 2019, with a compound annual growth rate of 20%. According to the “2019 China Pet Industry White Paper” survey, China’s urban residents had 55.03 million pet dogs and 44.12 million pet cats. The huge number of pets determines the large number of pet food and supplies manufacturers.

Thousand of Companies

There are more than 4,000 pet companies in China. Only 10% of large and medium-sized companies have fixed assets of 10-50 million yuan. Small companies with fixed assets of less than 10 million yuan account for 90%. Most of these companies are private enterprises. Mainly concentrated in Hebei, Shanghai, Shandong, Tianjin, Beijing, Anhui, Guangdong and other places.

Product Categories and Main Region of Productions

In recent years, Chinese pet industry manufacturers have gradually adjusted their product categories, Forming a production focus area for pet snacks and dry food in the Bohai Rim region focusing on Tianjin, Shandong, and Hebei;

Production focus areas for pet toys, dry food and chews focusing on Shanghai, Jiangsu and Zhejiang

While for pet clothing and clothing production focusing on Guangzhou and Shenzhen

OEM / ODM

Chinese pet food and supplies manufacturers are still in the lower reaches of the entire industrial chain, mainly OEMs for well-known foreign brands, and lack of Chinese companies’ own brands. Chinese manufacturers have been engaged in pet-related industries for a long time, but they have been cooperating with overseas supermarkets, pet product brands and e-commerce platforms for a long time. Most of them are based on ODM/OEM production mode, and their export destinations are mainly in Europe and North America. In recent years, manufacturers have gradually shifted from the ODM/OEM model to the development of independent pet brands.

Exports

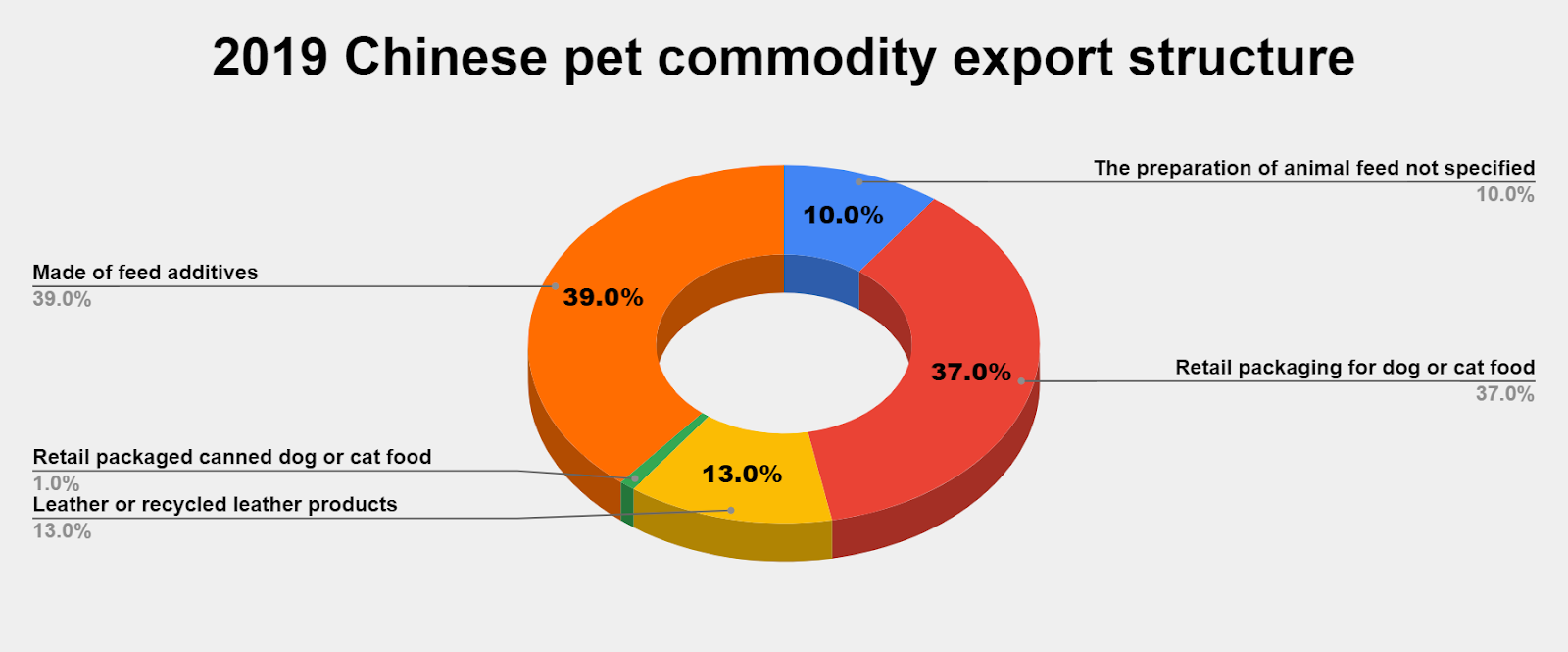

The total value of China’s pet product exports in 2019 was 15.4 billion yuan, mainly pet feed. “Retail packaged dog food or cat food feed” and “prepared feed additives” are the main exports of China’s pet industry. In 2019, the export value was 5.7 billion yuan and 6 billion yuan, respectively, accounting for the total export value of pet products. 37% and 39%.

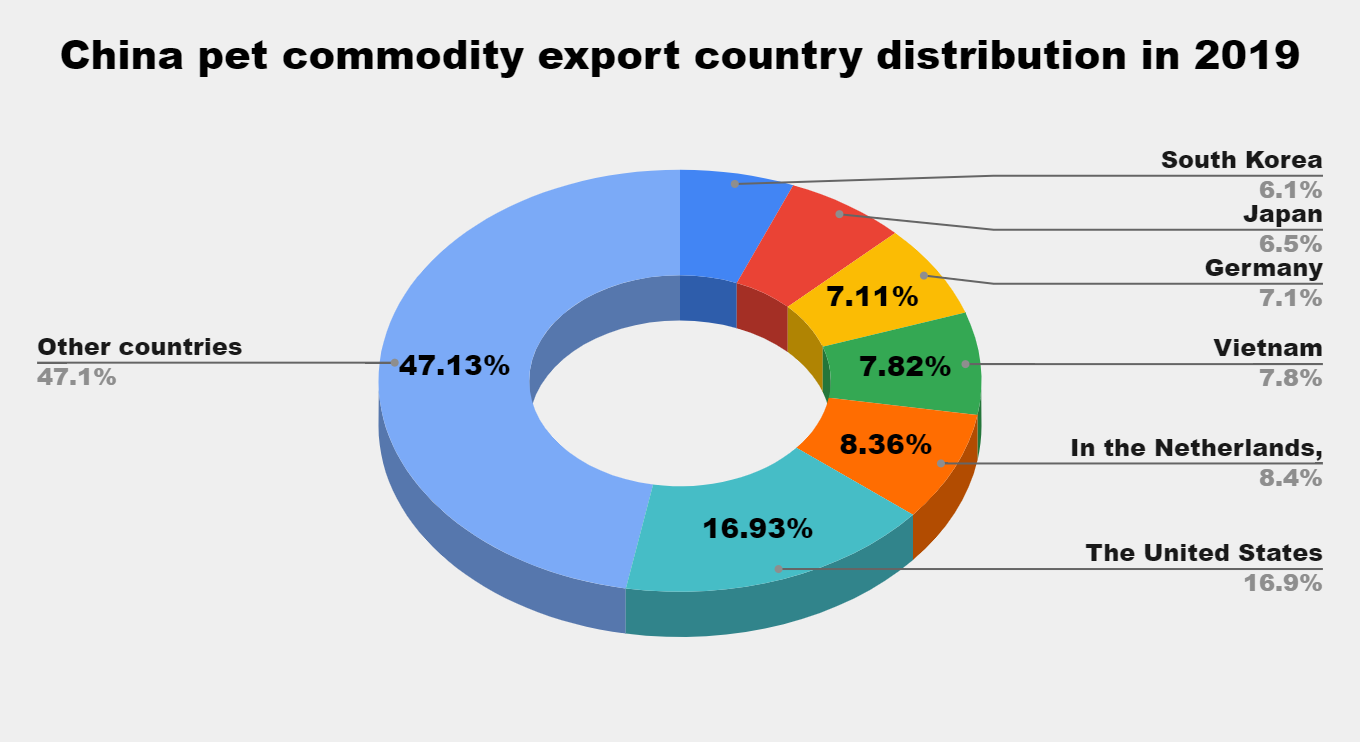

From the perspective of exporting countries, China’s pet commodity export market is relatively fragmented. The United States is the most important exporter of China’s pet food. In addition, the Netherlands, Germany and Japan also occupy a place in the export market.

In 2019, China’s exports of “retail packaged dog food or cat food feed”, “unlisted animal feed” and “feed additives” were only 135 million yuan.

(The above data comes from the “2019 China Pet Industry White Paper”, China Customs data and other public data)